If you are ready to scale your dropshipping store, you’ve likely hit a wall called ‘legal compliance.’ I’ve seen thousands of sellers at ASG start with high hopes, only to get stuck wondering when they can finally buy tax-free from suppliers. The ‘permit number’—often called a seller’s permit or sales tax ID—is the golden ticket that legitimizes your business and protects your margins. But the big question remains: how long will you be waiting before you can officially launch?

In this guide, I’m breaking down the actual timelines for obtaining your permit number in 2026. From instant digital approvals to those frustrating three-week mail delays, we’ll look at what affects your wait time and how to speed up the process. Whether you are a Shopify veteran or a newcomer testing the waters, understanding these timelines is the difference between a smooth launch and a legal headache.

Key takeaways

- Most US states provide permit numbers instantly or within 24 hours via online portals.

- Paper applications can take 2 to 4 weeks to process via mail.

- A permit number is essential to avoid paying sales tax to your suppliers.

- States like Florida and Texas are among the fastest for digital processing.

- Economic nexus thresholds (usually $100k sales) trigger the legal need for permits in multiple states.

Understanding the Permit Number: Core Concepts

Understanding the Permit Number: Core Concepts – Visual Guide

Understanding the Permit Number: Core Concepts – Visual Guide

In the world of dropshipping, a ‘permit number’ usually refers to a Seller’s Permit or a Sales Tax ID. This is a unique identifier issued by a state government that authorizes you to collect sales tax from customers and, crucially, allows you to purchase inventory without paying sales tax yourself. According to shopify.com, most online sellers will eventually need this paperwork to maintain compliance as they grow.

It is vital to distinguish this from a general business license. While a business license gives you the right to operate in a city, the seller’s permit is what suppliers like ASG or AliExpress look for before they waive tax on your orders. As noted by dropship.it, this permit effectively makes you an intermediary between the government and the consumer. Without it, you are essentially double-taxed, which eats into your already thin dropshipping margins.

There are three key components to these permits: the state nexus (where you have a physical or economic presence), the tax collection responsibility, and the resale certificate. The resale certificate is often a secondary document you fill out using your permit number to prove to your supplier that you are a legitimate reseller.

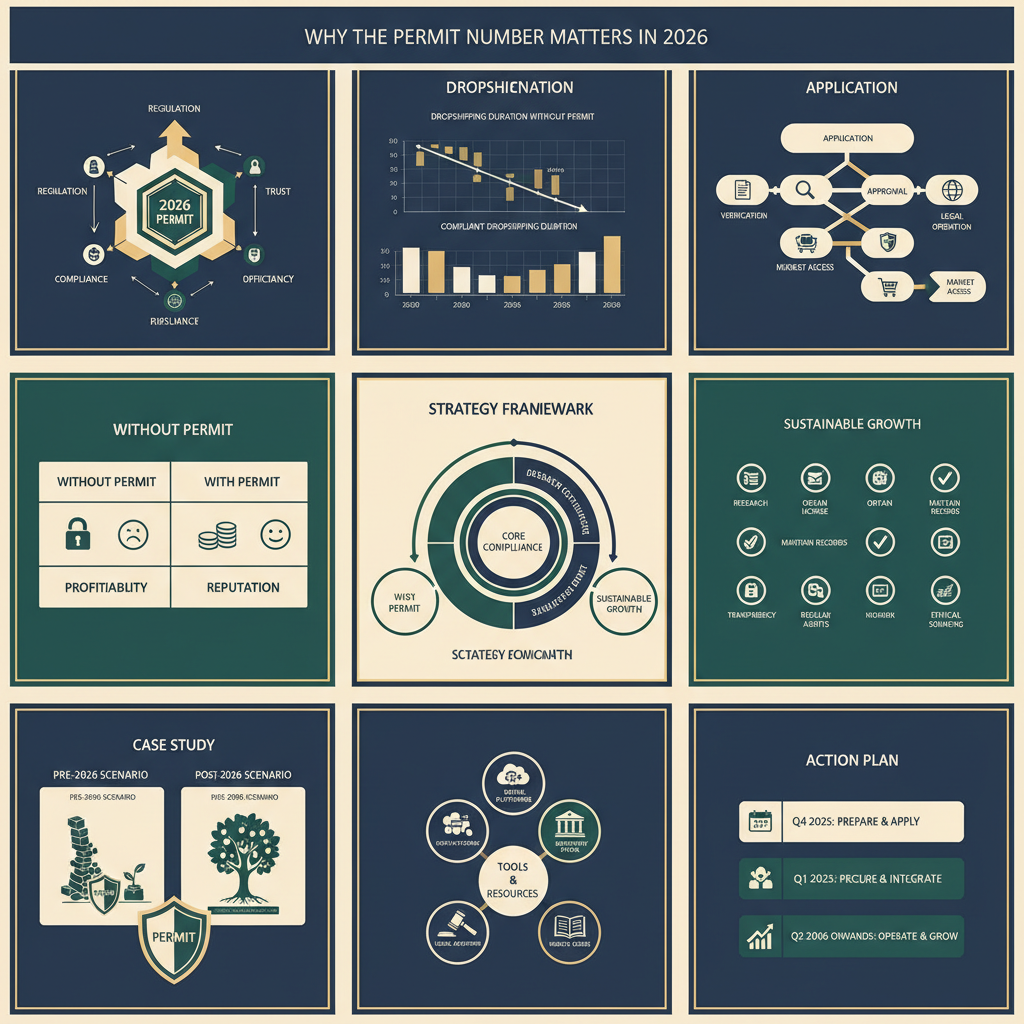

Why the Permit Number Matters in 2026

Why the Permit Number Matters in 2026 – Visual Guide

Why the Permit Number Matters in 2026 – Visual Guide

The landscape of ecommerce has shifted dramatically toward stricter enforcement. By 2026, automated tax software and platform integrations have made it nearly impossible to ‘fly under the radar.’ Most states now enforce economic nexus laws, where reaching a specific sales volume—often $100,000 or 200 transactions—requires you to register for a permit even if you don’t live there. inventorysource.com highlights that revenue thresholds are a primary deciding factor for legal obligations.

Data shows that 45 US states now require some form of sales tax collection for remote sellers. If you are dropshipping high-ticket items, you will hit these thresholds faster than you think. Furthermore, major suppliers are now being audited more frequently, meaning they will refuse to work with you unless you provide a valid permit number up front. This isn’t just about ‘being legal’; it’s about business continuity.

| State Type |

Typical Nexus Threshold |

Permit Requirement |

| High Volume |

$100,000 / 200 Sales |

Mandatory |

| No Sales Tax |

N/A (AK, DE, MT, NH, OR) |

Not Required |

| Standard |

$100,000 |

Mandatory |

According to shopify.com, failing to obtain these permits can lead to back-taxes and heavy fines that can bankrupt a small dropshipping operation before it even matures.

Implementation Strategies: How to Get Your Number Faster

To get your permit number quickly, you must prioritize online registration. Most states have moved toward ‘Express’ portals that verify your EIN (Employer Identification Number) in real-time. If you have your business structure (LLC or Sole Proprietorship) and EIN ready, the application usually takes less than 20 minutes. As shopify.com suggests, having your business details organized before you start the application is the best way to avoid delays.

Step 1: Register your business entity and get an EIN from the IRS. This is usually instant. Step 2: Visit the Department of Revenue website for your home state. Step 3: Fill out the ‘Sales and Use Tax’ application. Many states, such as California or Texas, provide a temporary permit number immediately upon submission of the digital form.

If you are dropshipping internationally, the process varies. However, for US-based sellers, the ‘Home State’ permit is your first priority. Once you have this, you can use it to generate resale certificates for your suppliers. I always recommend my clients at ASG to apply for their permit the same week they set up their Shopify store to ensure they are ready for their first bulk order.

Common Mistakes to Avoid: Lessons from the Field

The biggest mistake I see is sellers confusing the ‘Seller’s Permit’ with a ‘Resale Certificate.’ They are not the same thing. You use the permit number to create the certificate. Another common pitfall is applying via mail. In 2026, mail-in applications are a black hole. While an online application might take 24 hours, a paper form can easily take 30 days. inventorysource.com notes that understanding these legal nuances is a necessity for sustainability.

Don’t wait until you hit $100k in sales to think about permits. While that is the legal threshold for other states, you usually need a permit in your own state from day one if you have a physical presence. Waiting too long can result in your Shopify Payments account being frozen or your supplier charging you tax that you can’t easily recover.

Lastly, avoid using third-party ‘permit filing’ services that charge $200 for something that is free in most states. Most state websites are user-friendly enough that you don’t need to pay a middleman. Save that money for your ad spend or product testing.

Pro Tips from Janson: Insider Insights

After helping over 1,000 clients navigate the supply chain at ASG, I’ve noticed a pattern: the most successful dropshippers treat their permit number as a professional asset, not a chore. If you want to move fast, apply for your permit in a ‘business-friendly’ state if you have the option of a virtual office, though your resident state is always the safest bet. According to shopify.com, regulations vary by country, so always focus on your primary market first.

One ‘pro move’ is to keep a digital folder with your Permit, EIN, and a pre-filled Resale Certificate. When you find a new supplier, you can send these documents in one email. This builds instant trust. Suppliers are people too; they would much rather work with a ‘pro’ who has their paperwork ready than a ‘newbie’ who doesn’t know what a Sales Tax ID is.

Also, keep an eye on ‘Marketplace Facilitator’ laws. Platforms like Amazon and eBay often collect tax for you, but that doesn’t exempt you from needing a permit number to buy your goods tax-free. Always double-check your state’s specific rules regarding ‘Use Tax’ to ensure you aren’t leaving money on the table.

Key Takeaways & Next Steps

In summary, getting your permit number for dropshipping is a relatively fast process if you stay digital. Expect an instant to 24-hour turnaround for most US states, and up to two weeks for others. This permit is your ticket to higher margins and legal safety. dropship.it emphasizes that any business selling taxable goods online must eventually obtain one.

Your next steps are clear: 1. Confirm your business structure. 2. Get your EIN from the IRS. 3. Apply for your state’s seller’s permit online today. 4. Provide that number to ASG or your chosen supplier to start saving on sales tax immediately. Don’t let the fear of ‘paperwork’ slow down your entrepreneurial journey.

| Action |

Platform |

Estimated Time |

| Get EIN |

IRS.gov |

Instant |

| Apply for Permit |

State DOR |

20 Minutes |

| Receive Number |

Email/Portal |

0 – 5 Days |

| Verify with Supplier |

Email |

1 – 2 Days |

Sources and further reading (selected)

- Shopify Blog: Comprehensive guide on business licensing for online stores in 2026. Read more →

- Inventory Source: Legal nuances of dropshipping and revenue thresholds for permits. Read more →

- Shopify Retail: Detailed breakdown of seller’s permits vs. business licenses. Read more →

- Dropship.it: Comparison of legal documents required for dropshipping operations. Read more →

- Shopify UK: Step-by-step guide on obtaining permits and associated costs. Read more →

- IRS.gov: Official portal for obtaining Employer Identification Numbers (EIN). Read more →

- California CDTFA: Example of a state portal providing instant seller’s permits. Read more →

- Texas Comptroller: Information on sales tax permit wait times and requirements in Texas. Read more →

- Florida Dept of Revenue: Online registration for sales and use tax in Florida. Read more →

- TaxJar: Resource for understanding economic nexus and sales tax compliance. Read more →