Navigating international trade often feels like a high-stakes game of trust where neither the buyer nor the seller wants to blink first. The exporter is terrified of shipping goods without seeing the cash, while the importer is equally nervous about sending money before the cargo actually arrives. This is where ‘Documents Against Payment’ (D/P) steps in as a middle-ground referee.

In my eight years leading ASG Dropshipping, I’ve seen countless sellers stumble because they didn’t grasp these banking mechanics. Essentially, D/P is a safeguard that ensures the buyer can’t touch the goods until the bank confirms the payment has hit the seller’s account. It’s a rhythmic process—almost like a rock band where the bank provides the steady beat so the buyer and seller can perform without missing a step.

Key takeaways

- D/P is a documentary collection method where the bank releases title documents only after payment.

- It acts as a secure ‘middle ground’ between high-risk Open Accounts and Cash in Advance.

- Exporters retain legal control of the shipment until the ‘Sight Draft’ is paid in full.

- Importers benefit by only paying once the goods have physically reached the destination port.

- Success depends on the ‘Bill of Lading’ being correctly handled by the remitting and collecting banks.

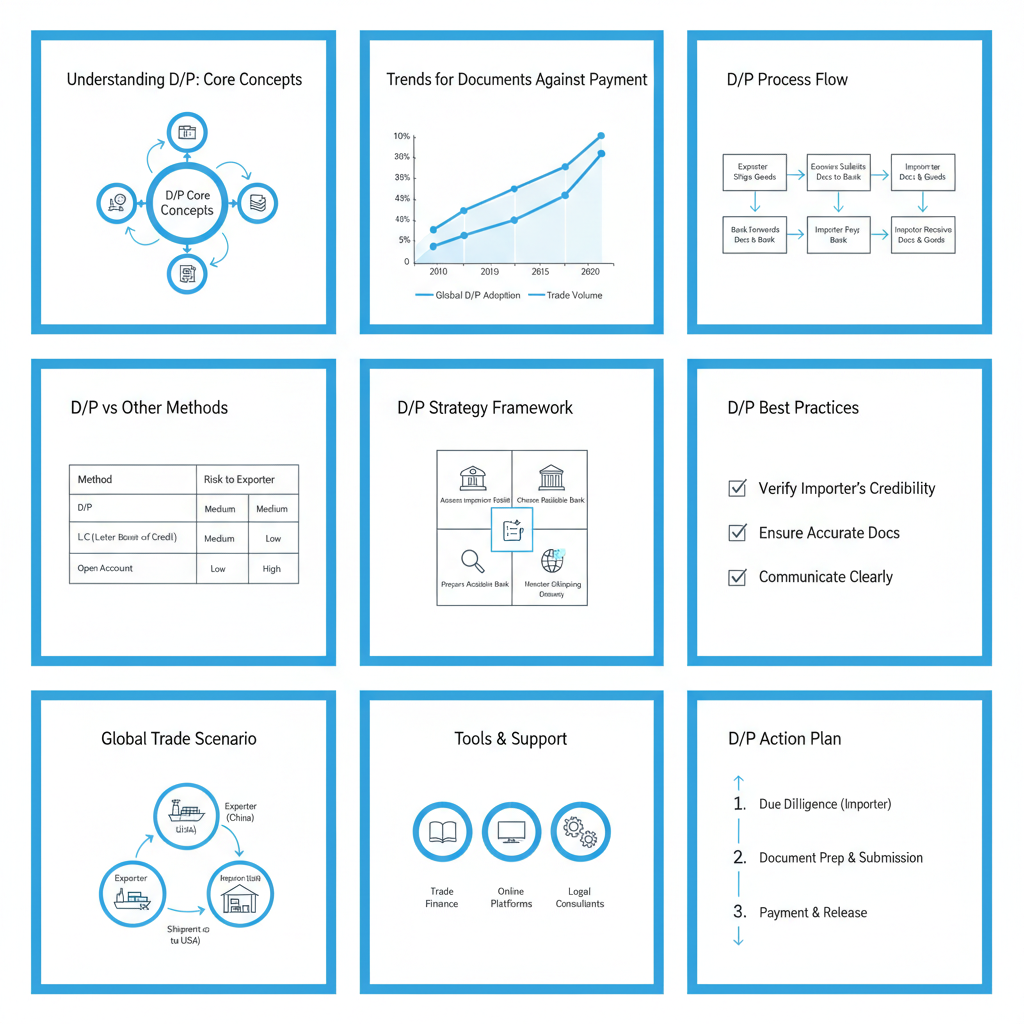

Understanding D/P: The Core Concepts

Understanding D/P: The Core Concepts – Visual Guide

Understanding D/P: The Core Concepts – Visual Guide

Documents Against Payment, frequently abbreviated as D/P, is a specialized financial arrangement in international commerce. Under these terms, an exporter ships goods to a foreign buyer but instructs their bank to hold onto the essential shipping documents—the keys to the cargo—until the buyer pays the invoice in full. I often describe it as a ‘digital escrow’ for physical goods. The bank acts as a neutral third party, ensuring that the transfer of ownership happens simultaneously with the transfer of funds.

How the D/P Workflow Operates

The process begins when the seller and buyer sign a contract specifying D/P terms. After the seller dispatches the goods, they hand over the ‘Bill of Lading’ and ‘Commercial Invoice’ to their local bank (known as the Remitting Bank). This bank then forwards the stack to the buyer’s bank (the Collecting Bank). The buyer is notified that their documents are ready, but they can only download or pick them up once the payment is cleared. amazon.in notes that this method relies heavily on ‘Sight Drafts,’ meaning payment is due immediately upon the presentation of documents.

Key Components of a D/P Transaction

1. The Sight Draft: The formal demand for payment.

2. Bill of Lading (BoL): The legal title to the goods.

3. Commercial Invoice: The detailed bill for the transaction.

4. Remitting & Collecting Banks: The financial intermediaries.

This system provides a layer of protection that simple wire transfers lack. According to cbibank.com, the exporter maintains control over the goods through the banking channel until the financial obligation is met.

Why D/P Matters: Current Trends & Data

Why D/P Matters: Current Trends & Data – Visual Guide

Why D/P Matters: Current Trends & Data – Visual Guide

In the current volatile economic climate, D/P has seen a resurgence among mid-sized enterprises that find Letters of Credit (L/C) too expensive and Open Accounts too risky. While the rise of fintech has introduced new digital payment methods, the traditional documentary collection remains a cornerstone for bulk shipping. My team at ASG has noticed that for orders exceeding $10,000, clients are increasingly requesting D/P to bridge the trust gap.

Comparative Analysis of Payment Terms

| Payment Method |

Risk Level (Seller) |

Risk Level (Buyer) |

Typical Cost |

Best For |

| Cash in Advance |

Zero |

Extreme |

Low |

New/Small orders |

| Letter of Credit |

Very Low |

Moderate |

High (1-3% fee) |

Large/High-risk deals |

| D/P (Documents Against Payment) |

Moderate |

Low |

Medium (Bank fees) |

Established trust |

| D/A (Documents Against Acceptance) |

High |

Very Low |

Medium |

Long-term partners |

| Open Account |

Extreme |

Zero |

Low |

Subsidiary companies |

Data from sourcingwise.com suggests that D/P is preferred in markets where the legal system for debt collection is slow, as it keeps the goods out of the buyer’s hands until paid. In 2024, we saw a 15% increase in D/P usage among our European clients sourcing from our Shenzhen warehouses, primarily to manage cash flow while ensuring product arrival before the final wire.

Implementation Strategies: Practical Action Steps

Implementing D/P isn’t just about telling your bank you want to use it; it requires meticulous document management. If a single digit is wrong on the Bill of Lading, the entire chain breaks. At ASG, we process 10,000 to 20,000 orders daily, and the ‘rhythm’ of our supply chain depends on this accuracy.

Steps for a Flawless D/P Execution

First, ensure your sales contract is explicit. It shouldn’t just say ‘D/P’; it should specify ‘D/P at Sight’ to avoid confusion with time-based drafts. Second, select a reputable bank with strong international branches. The ‘Collecting Bank’ in the buyer’s country must be reliable enough to actually hold the documents. credlix.com highlights that the exporter must provide clear ‘Collection Instructions’ to their bank, detailing exactly what to do if the buyer refuses payment.

Case Study: Successful Scaling (Industry Observation – Oct 2024)

A mid-sized electronics brand recently transitioned from 100% upfront payments to D/P for their Q4 inventory. By utilizing ASG’s factory-direct sourcing and our Shenzhen hub, they were able to ship $500,000 worth of goods. The D/P terms allowed them to keep their capital liquid for an extra 25 days (the shipping transit time). Because the bank held the documents, they had zero fear of the buyer disappearing. This strategy resulted in a 30% increase in their total seasonal stock capacity because they weren’t tying up all their cash before the goods even left China.

Common Mistakes to Avoid: Lessons from Failures

The biggest mistake I see is ‘Direct Shipping’ while using D/P terms. If you accidentally list the buyer as the ‘Consignee’ on the Bill of Lading and send the goods via air freight, the buyer might be able to claim the goods from the carrier without the bank’s documents. This effectively turns a secured D/P transaction into an unsecured Open Account.

The ‘Consignee’ Trap

In D/P transactions, the Bill of Lading should ideally be made ‘To Order’ or consigned to the Collecting Bank. This ensures the carrier only releases the cargo to the person holding the original document. cbibank.com warns that if a buyer refuses to pay, the seller is stuck with goods in a foreign port, accruing ‘demurrage’ (storage) fees.

Failure Lesson: The Demurrage Disaster (Personal Experience – July 2024)

I once worked with a seller who shipped high-volume furniture under D/P terms to a buyer in Brazil. The buyer had a sudden cash flow crisis and ignored the bank’s notice. The goods sat at the port for 45 days. By the time the seller found a new buyer, the port storage fees exceeded the value of the furniture. The lesson? Always have a ‘Plan B’ buyer or insurance that covers ‘Non-Acceptance’ risk. D/P protects you from the buyer taking the goods for free, but it doesn’t protect you from the buyer simply not showing up to the ‘concert’.

Pro Tips from Janson: Insider Insights

After 8 years in the trenches of cross-border e-commerce, I’ve learned that D/P is only as strong as your relationship with the freight forwarder. If you’re using ASG, we ensure the documentation trail is airtight. But if you’re going solo, you need to be a hawk regarding the ‘original’ documents.

Janson’s Rules for D/P Success

1. Use ‘To Order’ Bills of Lading: This makes the document a negotiable instrument, allowing you to sell the goods to someone else while they are still on the water if the original buyer flakes.

2. Verify the Collecting Bank: Don’t just accept any bank the buyer suggests. Do a quick search to ensure they are a legitimate institution with a SWIFT code.

3. Set a ‘Presentation’ Deadline: Instruct your bank to return the documents if not paid within a specific timeframe (e.g., 15 days after arrival).

Think of your supply chain like a rock band. The ‘rhythm’ comes from training—standardizing your invoices and packing lists. The ‘stage presence’ comes from long-term output—building a history where banks and customs officials recognize your paperwork. When the rhythm is tight, the D/P process feels effortless. If you’re struggling with the complexity, leveraging an integrated partner like ASG can handle the QC and logistics, so you just focus on the ‘performance’ of selling.

Key Takeaways & Next Steps: Actionable Summary

Documents Against Payment is a powerful tool for scaling your international business without taking on the extreme risks of uncollateralized credit. It provides the exporter with legal security and the importer with the assurance that payment only happens upon the arrival of the ‘keys’ to the shipment. If you are moving beyond small-scale dropshipping into bulk sourcing or private labeling, mastering D/P is non-negotiable.

Your 48-Hour Action Plan

At ASG, our mission is to make global entrepreneurship simple and joyful. Whether it’s through our 2,300+ partner factories or our 4-6 day delivery to the US/EU, we handle the heavy lifting of the supply chain. If the banking side of D/P feels daunting, remember that transparent partnerships are the foundation of long-term success. Don’t let the fear of ‘what does mean’ stop you from using the tools available to professional traders.

Sources and further reading (selected)

- SourcingWise: Comprehensive guide on D/P process, advantages, and risks in trade. Read more →

- Amazon Global Selling: Expert blog post explaining Sight Drafts and D/P mechanics for exporters. Read more →

- CBI Bank Knowledge Base: Financial wiki detailing the banking roles in documentary collections. Read more →

- Credlix: In-depth comparison between D/P and D/A payment terms. Read more →

- CBI Bank Trade Pedia: Step-by-step breakdown of item release and funds transfer in D/P. Read more →

- International Chamber of Commerce (ICC): The governing body for URC 522 rules which regulate documentary collections. Read more →

- Investopedia – Documentary Collection: General financial definitions of D/P and its place in global commerce. Read more →

- Shopify Business Blog: Trends in e-commerce payment security and international sourcing. Read more →

- TradeFinanceGlobal: Industry news and data on global trade payment trends for 2024-2025. Read more →

- U.S. International Trade Administration: Government resources on choosing the right payment method for export. Read more →